KYC Verification

KYC Verification is essential for building trust in today’s digital financial ecosystem. FinoGates delivers secure, API-ready, and scalable identity verification solutions tailored for fintech platforms, digital banks, and other regulated industries. Our platform supports automated identity checks, cross-border compliance, and lightning-fast onboarding, helping teams meet global standards without slowing down operations.

Faster Onboarding With Real-Time ID Checks

Speed matters when onboarding customers. FinoGates enables real-time document validation and biometric ID matching, allowing businesses to perform KYC verification instantly with minimal friction. This streamlines customer journeys while reducing abandonment rates—no long wait times, no bottlenecks, just seamless identity confirmation at scale.

Global Compliance Made Simple

Expanding across regions often means dealing with complex and shifting regulations. FinoGates simplifies compliance by offering built-in checks for AML, sanctions lists, and jurisdiction-specific requirements. With automated workflows and centralized audit logs, our KYC verification engine keeps your operations compliant without manual oversight.

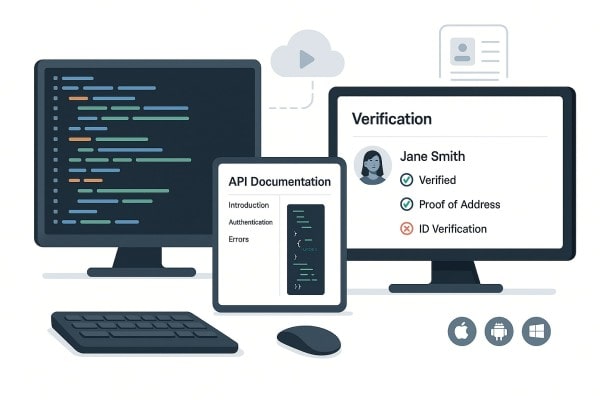

Developer-Friendly KYC APIs at Scale

FinoGates empowers developers with flexible APIs and SDKs built for fast deployment and continuous integration. Whether you’re embedding KYC into a mobile app or linking it to a core banking system, our tools provide scalable infrastructure for KYC verification across platforms. From video KYC to proof-of-address uploads, everything works seamlessly behind the scenes.

Frequently Asked Questions

What is KYC verification and why is it important?

KYC authentication is the process of confirming a user’s identity to meet regulatory requirements and prevent fraud. FinoGates provides tools that automate this process, ensuring accuracy and compliance while reducing onboarding time for both customers and teams.

How does KYC verification work in digital onboarding?

In a digital context, KYC authentication typically involves document uploads, biometric analysis, and real-time validation against global databases. FinoGates streamlines each of these steps with a fully integrated solution designed to be secure and user-friendly.

Is KYC verification required for all financial services?

Yes, most financial institutions are legally obligated to perform KYC authentication to comply with anti-money laundering laws and protect against identity fraud. FinoGates helps meet these requirements efficiently, without disrupting user experience or compliance workflows.

KYC Verification vs Manual Document Checking

Compared to the traditional manual processes, KYC authentication performed as part of the automated process is more precise, has lower error rates, and increased processing speed. Compared to latency and inconsistency exposure in manual screening, the automated platforms like those provided by FinoGates provide real-time screening, increased scalability, and compatibility ease with compliance infrastructure. This puts the businesses in a position to be nimble without putting too much at risk for the business.