Financial Services

Financial Services today demand more than legacy systems can offer. FinoGates delivers real-time, API-driven, and compliance-ready services for digital platforms that need to move fast without compromising on control. Our platform handles everything from seamless payments and KYC to dynamic fraud management, scaling with your growth. With infrastructure-ready modules and global regulatory support built in, teams can launch confidently and operate efficiently.

Launch and Scale With Embedded Infrastructure

Digital platforms require flexible, modular solutions to support evolving needs. FinoGates simplifies how you deploy financial services through robust embedded finance APIs that support a wide range of use cases. Our architecture scales easily, enabling fintech teams to launch new features, expand into new markets, and maintain uptime without overextending internal resources.

Stay Ahead of Risk With Smart Compliance Tools

Compliance should be proactive, not reactive. FinoGates equips banking services with AI-powered monitoring, rules-based engines, and automated alerting to identify risk. Whether you’re managing KYC updates or transaction screening, FinoGates supports faster decision-making while ensuring alignment with compliance standards.

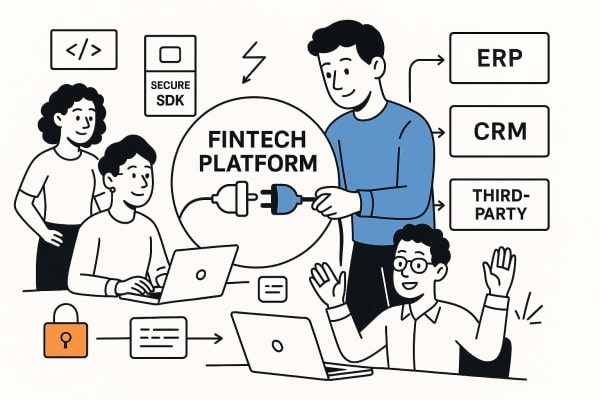

Seamless Integrations for Modern Teams

Time-to-market matters, especially for fintechs under pressure to scale. FinoGates enables rapid integration of banking services through pre-built SDKs, developer-friendly documentation, and secure APIs. Whether you’re connecting to ERP systems, CRMs, or third-party vendors, our platform keeps your teams agile while minimizing integration fatigue and long implementation cycles.

Frequently Asked Questions

What are financial services and how do they work in fintech?

Financial services in fintech include tools and infrastructure that enable digital transactions, identity verification, and regulatory compliance. FinoGates offers a suite of APIs and compliance tools that help fintech platforms deliver secure, user-friendly financial experiences while staying aligned with global regulations.

Are financial services safe for startups and small businesses?

Yes, under the right provider. FinoGates offers enterprise-grade financial services with protection from fraud, data encryption, and compliance screening safeguarding small businesses and start-ups without resorting to an army of security personnel.

How are financial services regulated in digital platforms?

It is location and activity-type dependent. FinoGates has platforms as per ever-changing laws through the provision of AML screening, automated reporting, audit logs, and integration-ready modules designed to ensure seamless continuous regulatory requirements.

Financial Services vs Traditional Banking Models

While traditional banking infrastructures are siloed in design and manual, the modern financial services space is all about agility, automation, and digital readiness. FinoGates solutions such as these enable onboarding quicker, real-time decision-making, and integration with third-party solutions easily, all while being compliant and reliable. Legacy platforms can't match the scalability, enhanced customer experience, and reduced operational complexity that API-based services provide, which makes them ideal for fintechs and new-age firms.